The $150,000 Handcuffs

Dear Clients and Friends, Over the past few years, the retirement planning industry has gone through significant changes in terms of legislation (apologies in advance for all the acronyms!). The CARES Act was passed in 2020, followed by SECURE 2.0 in late 2022. And who could forget the behemoth OBBBA that was passed on the 4th of July last year? One of the major hallmarks of SECURE 2.0 has already kicked in and created some confusion for the masses, especially for folks aged

Devin Rainone

Feb 6

Lords-a-Leaping, Prices-a-Creeping: 2025’s Christmas Price Index Breakdown

Dear Clients and Friends, As 2025 wraps up (no pun intended), we wanted to share something comical for this year’s last Weekend Reading. For the past 42 years, PNC Bank has kept tabs on the cost of each of the gifts given in the song “The Twelve Days of Christmas.” Spreading the holiday joy in 2025 cost 4.4% more compared to 2024. The main drivers of the increase were Five Gold Rings and a Partridge in a Pear Tree! See below for a whimsical chuckle. The PNC Christmas Price In

Devin Rainone

Dec 23, 2025

A Little Tax Loss Harvesting Never Hurt Nobody

Dear Clients and Friends, The famous Warren Buffett once said, “The first rule of an investment is: never lose money. Rule number two: never forget rule number one.” Though I strongly believe in the legendary investor’s cardinal rules, the reality is that people do lose money sometimes. Market dynamics constantly change, investment theses sometimes don’t pan out, and behavioral biases play Jedi mind tricks. I wish I could say I’ve never lost money on an investment, but I can’

Devin Rainone

Dec 5, 2025

10th Annual Giving with Purpose

Nothing beats giving a great gift - except for giving a great gift that also helps others.

Kirsten Warner

Nov 20, 2025

Halloween Costume Contest 2025 Results

Hello, Clients and Friends! Thank you so much for your responses to the Halloween Contest – once again, we have some insanely creative clients - it is always hard to decide! Now for the results.... Top Human Costumes First Place: Ashley and Howard as Lady Autumn and Lord of the Woods. They glued on every single leaf and stick - amazing! In honor of Ashley and Howard, MORWM is donating $500 to Planned Parenthood. Second Place: Chris and friends as Trekkie Angels! PSA - due t

Patricia Clarke

Nov 7, 2025

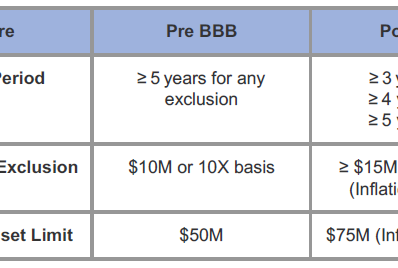

The One Big Beautiful Bill's Impact on Charitable Giving

Dear Clients and Friends, Now that the passage of the One Big Beautiful Bill has been digested by the masses, one area that has garnished much attention has been the impact on the charitable giving landscape. Needless to say, we don’t let the tax tail wag the dog when it comes to our personal giving, especially in today’s world where wars are ongoing, natural disasters are driving near record-high losses worldwide , and food insecurity and malnutrition continues to reach new

Devin Rainone

Oct 31, 2025

What the Crypto? A Cryptic Roller Coaster

Whether it’s from the news or conversations with your friends and family, we have to ask: have you ever heard of cryptocurrencies?

Devin Rainone

Oct 3, 2025

The One Big Beautiful Bill - Part 1

Dear Clients and Friends, I hope everyone is enjoying their summers so far! The 4th of July is a special day in American history,...

Devin Rainone

Jul 18, 2025

Mega State Tax Credit

What if I told you that instead of paying $20,000 in state taxes, you could donate $20,000 to charity and pay only $2,000 in taxes?

Greg Johnson

May 2, 2025

Bumpy Roads Lie Ahead

Many of you are scared right now, rightfully so. Therefore, I think a little context will help….

Matthew Ramer

Apr 25, 2025

2025 Earth Day & Arbor Day

The theme for Earth Day 2025 is “Our Power, Our Planet.” Our clients are showing up for our planet - here's how...

Amy Killeen

Apr 17, 2025

Never Let a Tariff War Go to Waste – 2025 Edition

Dear Clients and Friends, Given the recent market turmoil, I want to reiterate some strategies that we at MORWM consider when bear...

Devin Rainone

Apr 11, 2025

Woe is Me!

We’ve chosen 3 topics that we feel are the most significant to the current investment climate. They are: 1) Tariffs, 2) Immigration, and 3) Nationalism. You’re probably thinking, “How can you possibly leave politics out of those topics?” Well, watch how we do it…

Matthew Ramer

Apr 7, 2025

Let's Start this Discussion

Emotions drive the markets in the short run. Economics drive the markets in the long run.

Matthew Ramer

Mar 14, 2025

Santa's Bag of Beats

If earnings continue to surprise to the upside, it could justify the current valuations, but...

Matthew Ramer

Dec 13, 2024

9th Annual MORWM Giving with Purpose: A Holiday Shopping Guide that Gives Back

Inspiration to give a little more (or a little more deliberately) this holiday season

Kirsten Warner

Nov 22, 2024

The Sunset You’re Least Expecting

Welcome to post-election madness...

Devin Rainone

Nov 15, 2024

2024 MORWM Halloween Costume Contest Winners

Discos, dogs and race car drivers...we have it all!

Patricia Clarke

Nov 8, 2024

October Monthly Economic Risk Update

The wheels are on the ground. What's next?

Matthew Ramer

Nov 1, 2024

Memorial Day and Charity Tax Deductions

Dear Clients & Friends, Before we get into this Weekend Reading, let us acknowledge our excitement about the upcoming long weekend. While...

Matthew Ramer

May 24, 2024