June Market Risk Update

- Matthew Ramer

- Jun 17, 2023

- 5 min read

Dear Clients & Friends,

We published our monthly economic risk review last week. Today we are

publishing our monthly market risk review. Usually, we write one or the other,

depending on which one we find more interesting (or more terrifying, as can

sometimes be the case). Because we didn’t publish either one during last

month’s debt ceiling circus, we thought that we’d write both this month. A

hearty thanks to our good friend Peter Esele and to Dan Levinson here in our

Philly office for compiling data and assisting with our thesis.

May was a mixed month for the equity markets: technology-related stocks

rallied, while most other sectors remained flat or fell. The S&P 500 gained 0.43

percent, while the Dow Jones Industrial Average fell 3.17 percent. The Nasdaq

Composite (the tech-heavy index) led the way with a 5.93 percent gain; it was

supported by an increase in investor enthusiasm surrounding AI at the end of

the month.

Given the concerns about slowing growth and inflation, we have kept the

overall market risk level at yellow for now.

Recession Risk

Recessions are strongly associated with market drawdowns, as 8 of the last 10

bear markets have coincided with economic recessions. According to the

National Bureau of Economic Research, the last recession began in February of

2020, at the start of the pandemic. It ended soon afterwards, following swift

stimulus from the Fed to assist a stalling economy. Fast forward to today:

economic expansion continued throughout the month of May, with strong

hiring leading the charge. The bigger risk is a deeper slowdown in economic

activity as the Federal Reserve battles inflation by tightening the supply of

money.

Economic Shock Risk

Interest rates are a major systemic risk factor. The Federal Reserve controls

the “cost of borrowing money” by raising or lowering the overnight lending

rate that banks use. Because of this, the cost of things like mortgages and

business loans are affected; things that promote economic activity. The higher

interest rates go, the more expensive it is for companies to borrow money.

Therefore, economic activity slows down. (The reverse is also true - low rates

are a form of stimulus.) That being said, let’s take another look at the yield

curve, which is a newsworthy item that we financiers dwell on.

The yield curve is a graph that plots treasury bond yields vs. treasury bond

maturities. Just like with mortgages, normally the longer the duration, the

higher the rate. Easy breezy - the line graph usually goes from bottom left to

upper right. When the line in the graph changes direction (for instance, from

upper left to lower right), that tends to mean that investors are anticipating

lower interest rates in the future due to a slowing economy. Right now, to

some extent, that’s what we have. Let’s explore that and decide if it is

concerning.

As we mentioned in last week’s article, the yield curve inversion deepened in

May. However, let me reiterate that we are taking this inversion with a grain of

salt. Everyone knows that rates are high right now relative to recent years- we

hear about it every day on the news. Traditional thinkers would conclude that

rates will come down eventually, even if they go higher in the short run. So,

an inverted graph may not be alarming at this juncture.

In addition, Fed action tends to affect the “nearer” part of the ‘yield curve’

more quickly, while the “further away” part of the curve takes longer to catch

up. That being said, May 2023 marked eight straight months of a yield curve

inversion. While this does not guarantee a recession, it warns us that we

should be prepared for an economic slowdown in the future. Which, as we all

know, is among the Fed’s objectives as they fight inflation.

There are four major factors that we examine in order to monitor the health of

the market. They are: Valuations, Margin Debt, Technical Factors, and Market

Complacency.

Valuations

The chart above shows the price of the S&P 500 overlaid with the ten-month

change in price-to-earnings (PE) ratios. When the change in PE ratios drops

below zero over a ten-month period, the market typically drops shortly

thereafter. On a rolling ten-month basis, valuations declined 3.55% in May,

which is the largest decline in three months. This now marks 17 consecutive

months of declining valuations, which goes to show the dramatic effect that

Federal Reserve tightening has had on the markets. This metric remains at a

red flag.

Margin Debt

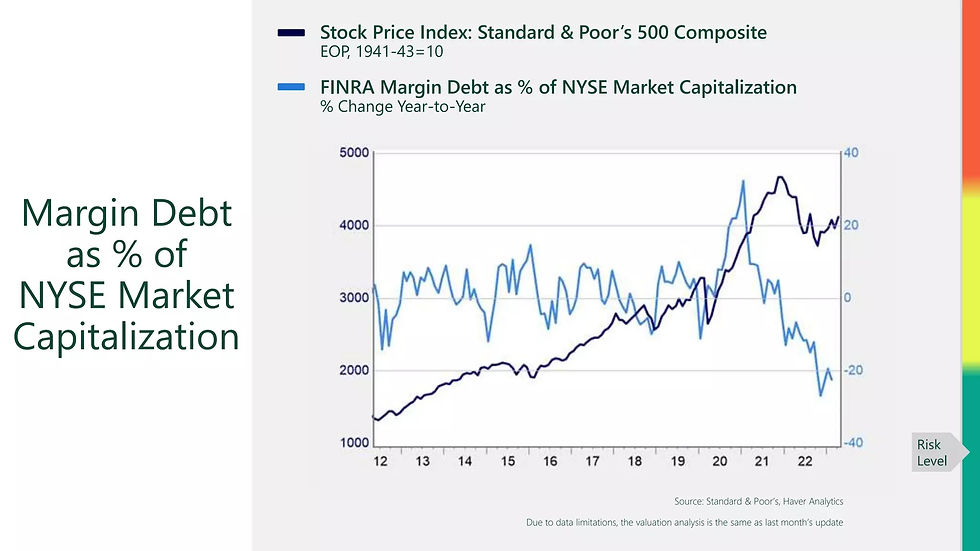

This chart shows us the price of the S&P 500 overlaid with Margin Debt as a

percentage of NYSE Market Capitalization. Margin Debt measures the amount

of money investors borrow against their own portfolios in order to further

invest in the markets. When investors are bullish, they tend to borrow more

for investing. However, this can also be a contrarian metric because investors

often become irrationally exuberant when the markets are doing well. To that

end, over-bullish sentiment can actually indicate a coming market decline.

Margin debt declined 22.4% on a year-over-year basis in February, which was

the 15th straight month of decline. With interest rates on the rise, and higher

borrowing costs, this makes a lot of sense. This indicator warrants a green

flag.

Technical Factors

This metric is a little more technical, but it’s very valuable. The chart above

shows the price of the S&P 500 overlaid with 200-day and 400-day moving

averages. By studying the markets’ movement along the 200 and 400-day

moving averages, we can smooth out day-to-day volatility and observe longer

term trends. In particular, we pay very close attention to when the 200-day

average breaks through the 400-day average; this signals that troubles are

ahead. The three major US indices (the S&P 500, Dow Jones Industrial

Average, and Nasdaq Composite) all finished above their 200- and 400-day

moving averages in May. This is the fifth straight month that all 3 indices

experienced technical support, which earns this indicator a green flag.

Market Complacency

This indicator is also somewhat technical. The “VIX” is an index that measures

market volatility, which is a very important metric. The chart above shows the

S&P 500 PE ratio divided by the VIX. Often, high valuations (measured by the

PE levels) signal that investors are confident and potentially complacent. When

the VIX is high and we see a lot of volatility, there is less complacency. The

reason that we measure these two indicators as a ratio is because periods of

high valuations and low volatility (2000, 2006-2007, and 2017) have typically

preceded a market drawdown by roughly twelve months. As we can see,

market complacency is on the rise: the VIX fell from 17.82 in April to 17.64 in

May, and forward PE ratios increased from 18 to 18.5. That being said, we are

nowhere near danger levels here, and we give this indicator a green flag.

Conclusion

While three of our four indicators received green flags, inflation and interest

rates continue to pose a threat to the markets. However, the successful

resolution of the debt ceiling standoff serves as a reminder that, although risks

are always present, the most likely path forward is continued growth and

economic improvement. Ultimately, the path back to “normal” will likely be

long, with setbacks along the way.

We expect economic growth and market appreciation over the long

term. However, the next two years are expected to be volatile, with swings

back and forth as the economy finds its post-COVID feet. As long-term

investors, we remain disciplined. As tactical practitioners, we plan to exploit

unnecessary fear-based market dips. As humans, we do worry about volatility

affecting our client’s peaceful sleep. Thus, we will continue to keep our family

of clientele informed.

We wish everyone a wonderful long weekend.

-Matt, Dan, and the rest of your MORWM home office crew